Luckin Coffee Plans US Launch to Compete with Starbucks

Luckin Coffee, China’s largest coffee chain, is set to enter the US market next year, aiming to undercut rivals like Starbucks with drinks priced around $2 to $3. With 20,000 locations in China, Luckin surpassed Starbucks in annual revenue for the first time in 2023. The company is focusing on cities with many Chinese students and tourists, using aggressive marketing tactics to build recognition, but will need to adapt its cashless model for the competitive US coffee market.

Chinese AI Unicorn MiniMax’s Talkie App Gains Global Popularity

Chinese AI startup MiniMax has seen its Talkie chatbot app become a hit in the U.S., ranking as the fourth most-downloaded AI app there in early 2024, surpassing rivals like Google-backed Character.ai. Globally, Talkie reached 17 million downloads, just behind Character.ai’s 19 million. Powered by generative AI, Talkie lets users interact with virtual characters and appeals especially to users aged 18-35, who make up over 70% of the companion AI market. MiniMax, based in Shanghai, is projected to earn around $70 million in 2024, driven by strong international demand for its avatar chatbot platform.

Xiaomi Enters Luxury EV Market with Ferrari-Like SU7 Ultra

Xiaomi has unveiled its second electric vehicle, the SU7 Ultra, a $114,000 luxury sports car that consumers compare to a Ferrari. Launched on Tuesday, the SU7 Ultra follows Xiaomi’s initial EV models in March and has quickly gained traction, with over 3,600 pre-orders in just 10 minutes. Since its debut, Xiaomi has delivered 75,688 SU7 sedans, rivaling EV giants like Tesla and BYD in monthly sales.

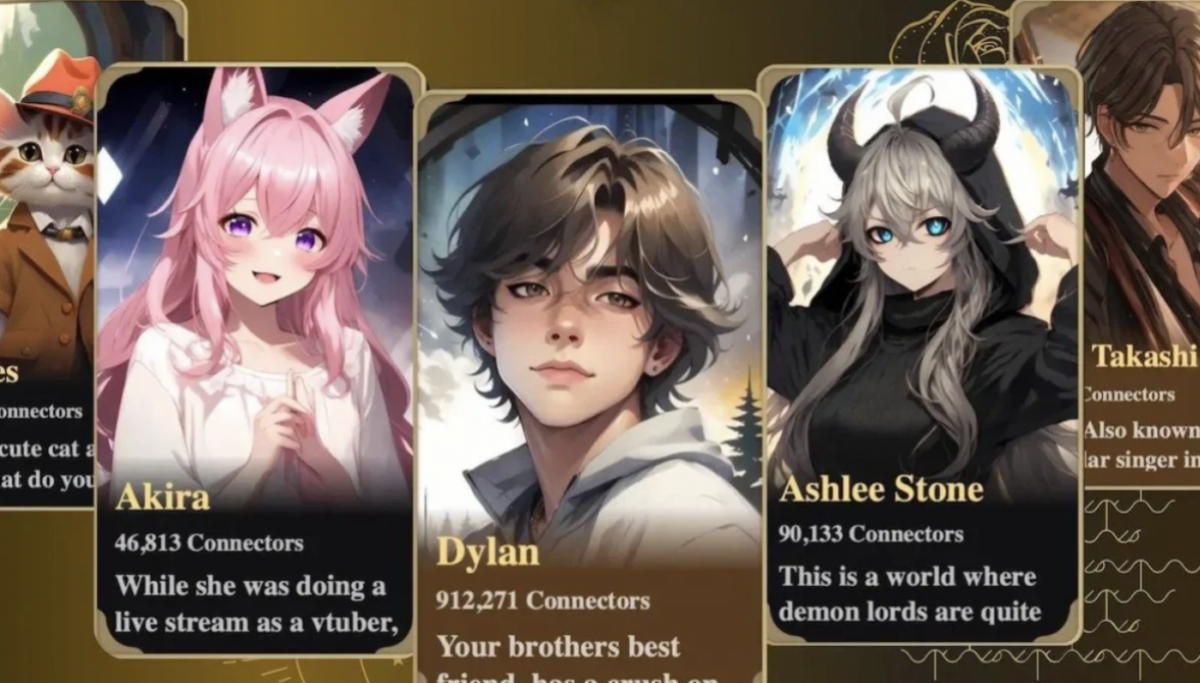

Intel Replaced by Nvidia in Dow Jones

Intel will exit the Dow Jones Industrial Average after 25 years, replaced by Nvidia, which has surged due to its dominance in AI-driven chip technology. Intel, once a chipmaking leader, has seen setbacks from missing key AI investments and losing ground to TSMC. Its shares have dropped 54% this year, while Nvidia’s have doubled. This shift underscores Nvidia’s growing influence as a $3.32 trillion company and Intel’s struggles to compete in AI, with Intel’s market cap falling below $100 billion for the first time in decades.

Indonesia Blocks Google and Apple Smartphone Sales Over Local Content Rule

Indonesia has banned sales of Google Pixel and Apple’s iPhone 16 due to a regulation requiring at least 40% locally manufactured components in smartphones sold domestically. The government aims to enforce fairness for investors by pushing companies to meet this threshold, according to Febri Hendri Antoni Arief from the industry ministry. Google noted its Pixel phones aren’t officially distributed in Indonesia, though consumers can purchase them abroad with applicable taxes. While local giants OPPO and Samsung lead Indonesia’s smartphone market, the restrictions could deter foreign investors.

Disney Launches New Tech Office to Drive AI and Mixed Reality Innovations

Disney is establishing the Office of Technology Enablement to coordinate its use of AI and mixed reality across film, TV, and theme parks. Led by CTO Jamie Voris, this team will explore how advanced technologies can enhance consumer experiences and integrate with Disney’s broader strategy. Disney’s ongoing tech push includes augmented, virtual, and mixed reality initiatives, aiming to bring immersive experiences to theme parks and homes. With competition intensifying in AR/VR, Disney is ramping up its expertise in emerging tech.

Toyota and NTT Invest $3.27B in AI to Tackle Traffic Accidents

Toyota and Nippon Telegraph and Telephone (NTT) will jointly invest 500 billion yen ($3.27 billion) by 2030 in an AI-based platform to reduce traffic accidents. This new mobility AI platform will leverage vast data to enhance driver-assist technology and support autonomous driving, addressing challenges like poor visibility and expressway merging. As Japanese carmakers face growing competition from Tesla and Chinese firms, Toyota and NTT aim to make this system widely available, collaborating with industry, government, and academia for adoption from 2030.